Crypto trading strategies are something that every day trader needs to get ahead in the game, minimize risk, and increase potential profits. General strategies are different from crypto day trading strategies because you approach the market in a different way.

Day traders are short-term oriented while traders, in general, can hold positions for several days or weeks.

Most crypto traders find it difficult to create a robust and reliable crypto trading strategy that produces positive results and real profits.

The problem is not the market, or the indicators, it’s the lack of understanding of the market works and how to really set yourself up with the right approach.

If you are a margin trader I highly recommend that you read our guide on crypto margin trading strategies.

Basics of trading strategies

When most traders think about how to execute a plan they immediately think about confusing technical indicators, 50 charts on one screen, and 5 screens on one desk.

The truth could not be further away from that.

I’m going to tell you what a real strategy is and how you can easily create your own with a simple analysis.

They are not what most people think they are.

So I’m asking you to be open to new learning and think outside the box.

First, let’s get the concept of a trading strategy clear.

Trading strategies are only a way of reacting to certain behavior.

Read that two or three times and really think about what you just read.

This may sound a little weird in the beginning.

But I’m going to explain what I mean and how real professional traders trade the market with real a crypto trading strategy.

When you are analyzing cryptocurrencies you are faced with different behaviors.

The coin might be:

- Volatile

- Calm

- Big

- Small

- Positive

- Negative

- Euphoric

- In panic

These are all some of the many behaviors that you need to know before you start.

There are definitely many more types of behaviors and it’s up to you as a crypto trader to figure out your own coin.

You can almost see the cryptocurrency as a person with emotions and it’s your job to figure out how it feels and how you are going to approach it.

Remember that these are the basics of behavior.

But they hold for crypto as well.

Now, it’s up to you to analyze which kind of behavior your coin is putting up each day or week.

This is the first thing you do before you start applying your crypto trading strategy.

If you don’t know how the coin is behaving, you can’t know which strategy to use.

Okay.

So, let’s say that you wake up, have your coffee, and sit down in front of the computer.

And the chart looks like this:

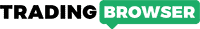

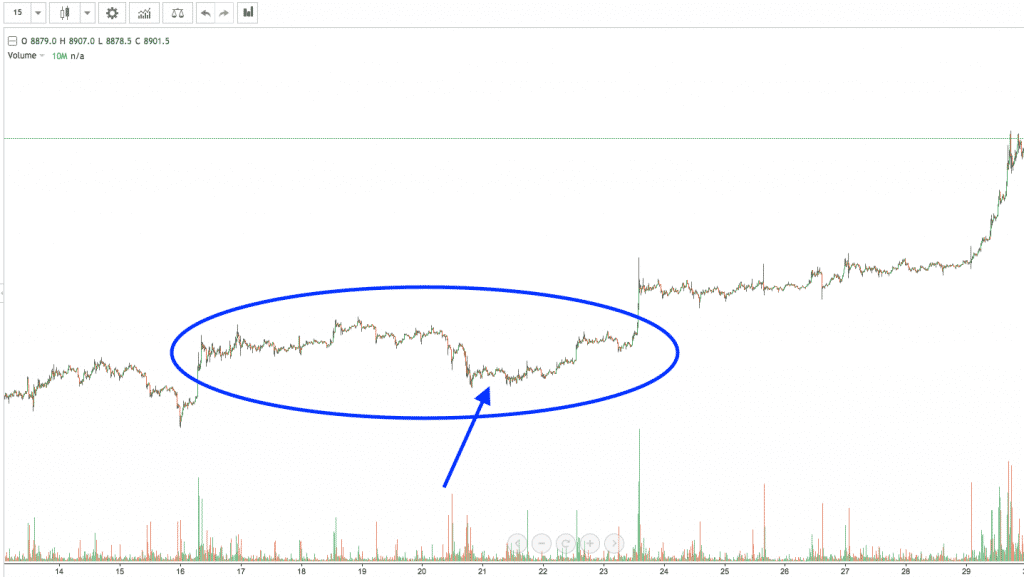

This is a screenshot of the Bitcoin chart.

First of all, we can definitely say that the coin is positive because it’s in an uptrend.

It has experienced higher volume along with higher highs.

It is a little bit larger than usual thanks to the volume coming in and this makes it more volatile.

Related: How to read crypto charts

Now we have established the behavior first, then we apply the crypto strategy best suited.

In this case with Bitcoin, we are going to adapt to this specific behavior.

First of all, we are only going to look to take long positions because the market is in an uptrend.

Secondly, we know the coin is a little big bigger and more volatile than usual.

So we need to widen our stop loss a little and lower the position size.

I also know that Bitcoin normally tests the downside before it takes off higher again.

We have established how Bitcoin is behaving and this tells us how to best approach any cryptocurrency.

This is what strategies are about.

First, you analyze your coin.

Then you use your analysis to decide how you are going to approach the behavior.

Then you start to look for ways to enter the market with this information.

This is how they are built.

It’s not more difficult than that.

You can now start creating your own strategies today with the same principles.

A question you can ask yourself before you start is:

What crypto trading strategy do I need to use to enter a cryptocurreny with this behavior?

Strategies with high risk

We’ve explained what crypto trading strategies are and now we are going to dive deeper into specific a strategy and how to use them.

Those with high risk are used when we are comfortable taking on more risk.

High risk basically means that the cryptocurrency is behaving in a riskier way.

One example of such a strategy would be to enter the market when it’s:

- Very Volatile

- Has a higher volume than normal

- Is at an extreme high or low

First, you have established that the cryptocurrency is behaving riskily.

Now it’s time to decide how to enter.

This is where practice and experience come in very handy and this is something you learn with time.

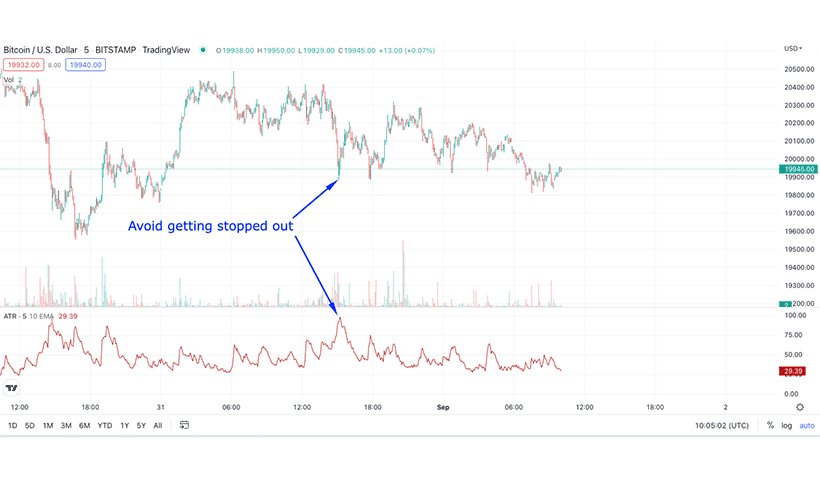

Let’s look at a chart that is behaving in a risky way:

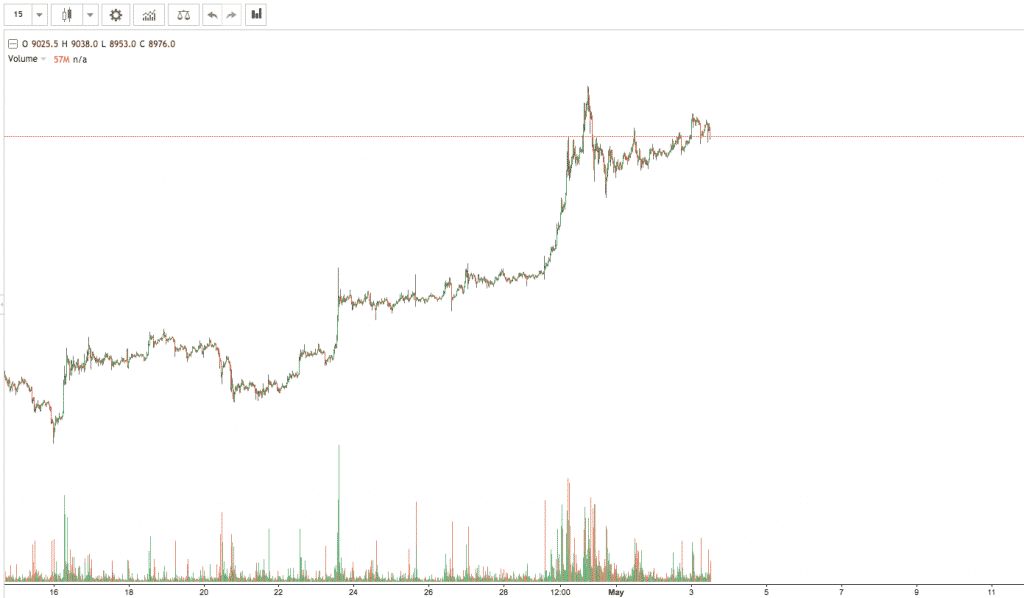

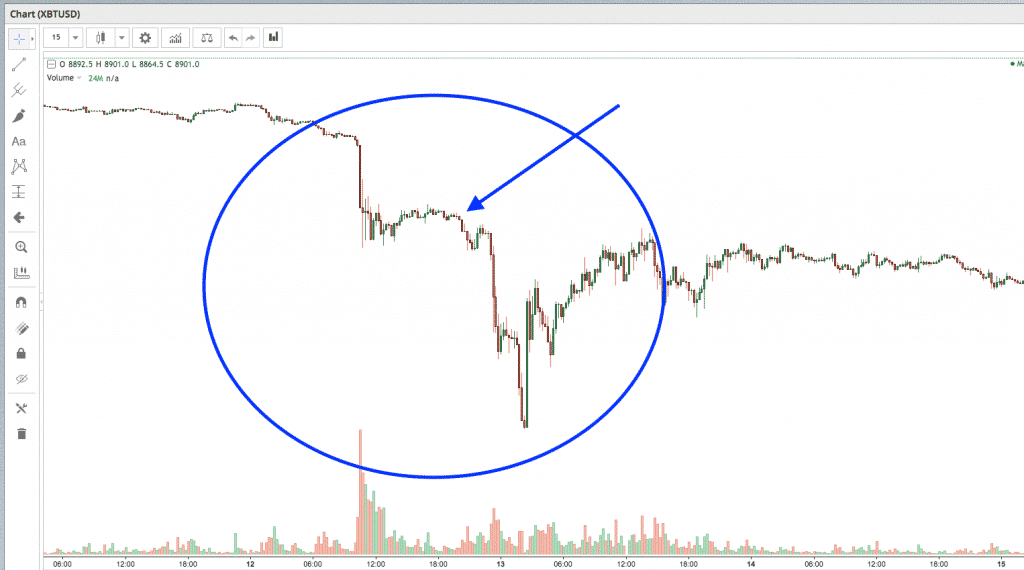

This is another screenshot of Bitcoin during the last crash.

It’s fair to say that the coin was behaving in a certain way during these days and weeks.

The behavior was:

- More volatile

- Bigger

- Was experiencing a higher volume

- Panicking

When you trade this chart you can’t use your standard stop losses or position sizes.

If you do so, you will be wiped out in minutes.

This happens in times when you are not using the correct strategy.

A good strategy here would be to first:

- Widen stop loss

- Reduce position size

- Choose short positions

When this is done we can start to look for setups in the chart, but at least we are using the right strategy for this coin.

A strategy with high risk is only applied in a risky environment.

Depending on what your personality is you may prefer to trade a more risky market.

This is up to every crypto trader to find out and then apply the correct strategy.

I have a good quote for this:

Risky trading strategies does not mean that you are risking more.

Related: Crypto exchanges with stop loss and trailing stop loss

Strategies with low risk

By now you should have some idea of what a strategy with low risk means.

Exactly.

A strategy with low risk does not mean that you are risking less capital.

It basically means that you are deciding how to trade a less risky market.

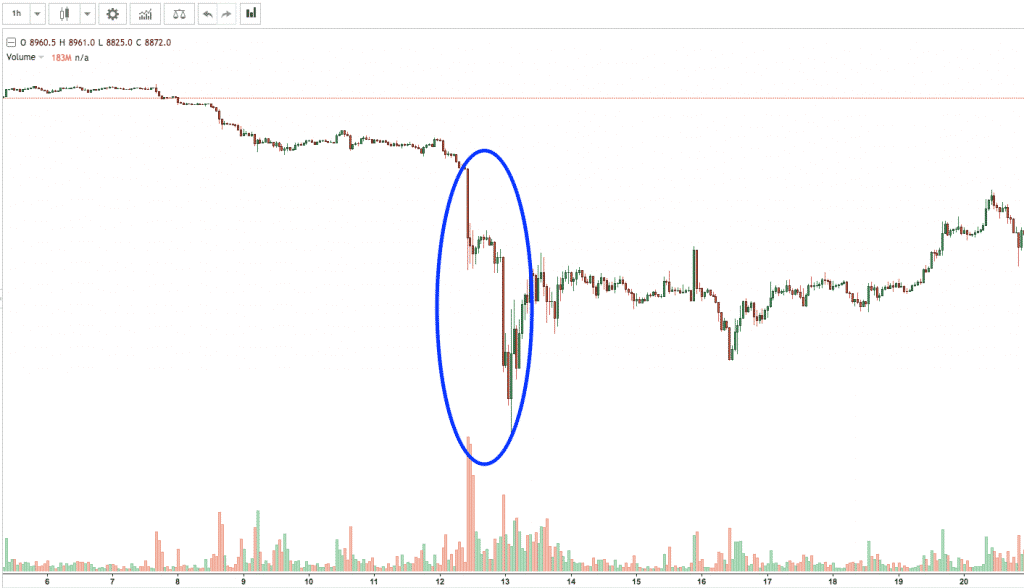

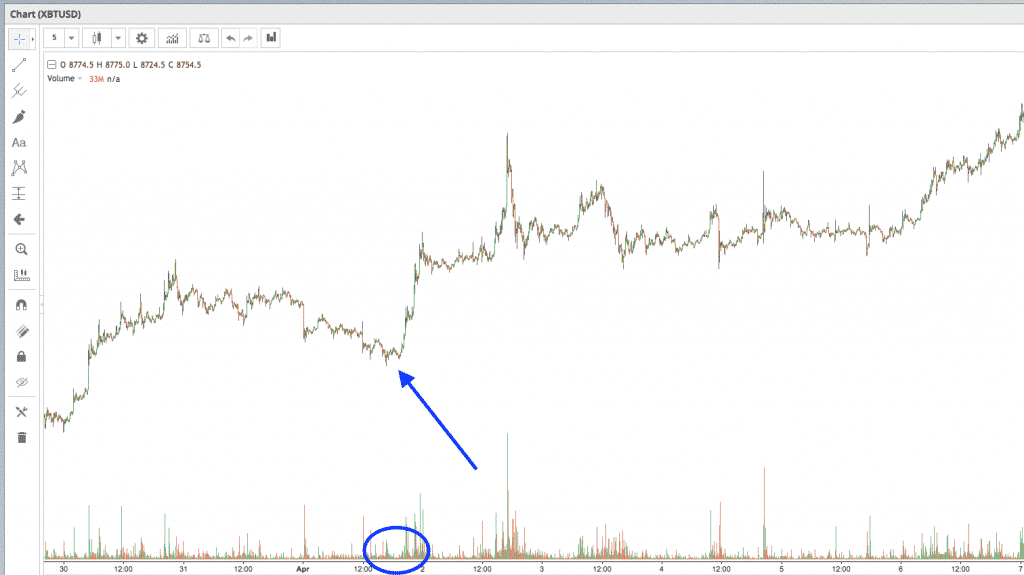

I’m going to show another screenshot of Bitcoin from a while back.

This time the market was behaving less risky:

This screenshot was taken a few weeks after the latest crash when cryptocurrencies in general were behaving less risky.

We can establish that it was:

- Less volatile

- Smaller

- Was experiencing less volume

- Calm

- Slightly positive

Immediately when we see this behavior we can start to apply less risky entry-exit plans.

We can start by:

- Tightening the stop loss

- Increase position size

- Choose long positions

After we have established this approach we can start to look for entries.

In this example, Bitcoin is showing a completely different behavior and it’s up to you to recognize that.

Once you have recognized that, you are then able to choose what strategy you want to use.

Before we dive into some other strategies I’m going to end this section with some trading wisdom.

Deciding how to approach a cryptocurrency depends on how it is behaving at the moment.

But how can we trust that the behavior is going to stay with the same behavior?

This is where it gets interesting.

A behavior is always changing, but very slowly.

When you have recognized a behavior you can trust that the coin will keep acting this way for a while.

Not for a year or 5 months, but a while.

This depends on the chart you are trading.

Some coins are like some humans, they change mood very quickly and seem to act randomly.

But they are not.

Learning to recognize behavior is the first step.

Then apply the right crypto strategy.

Are you looking to become a skilled crypto trader?

Check out our detailed crypto trading guides in our educational center.

You will learn new strategies and how to read charts in real-time.

Crypto trading strategies for low volatility

The reason I want to give you trading strategies for both low and high volatility is that cryptocurrencies are the master of both.

Sometimes the coin is acting crazy and it seems like it’s going to go through the roof or the floor.

Other times the market is doing almost nothing.

You need to know how to respond to this and choose among the ideas you have.

This is for two reasons.

First, to protect your trading capital.

Second, to maximize the profit potential.

In a low-volatility environment, you need to change your idea of how to enter and exit.

Since we’ve talked about the basics of trading strategies, I’m going to give you a little bit more advanced information.

But what can you do to maximize your profits and minimize your risk in a low-volatility environment?

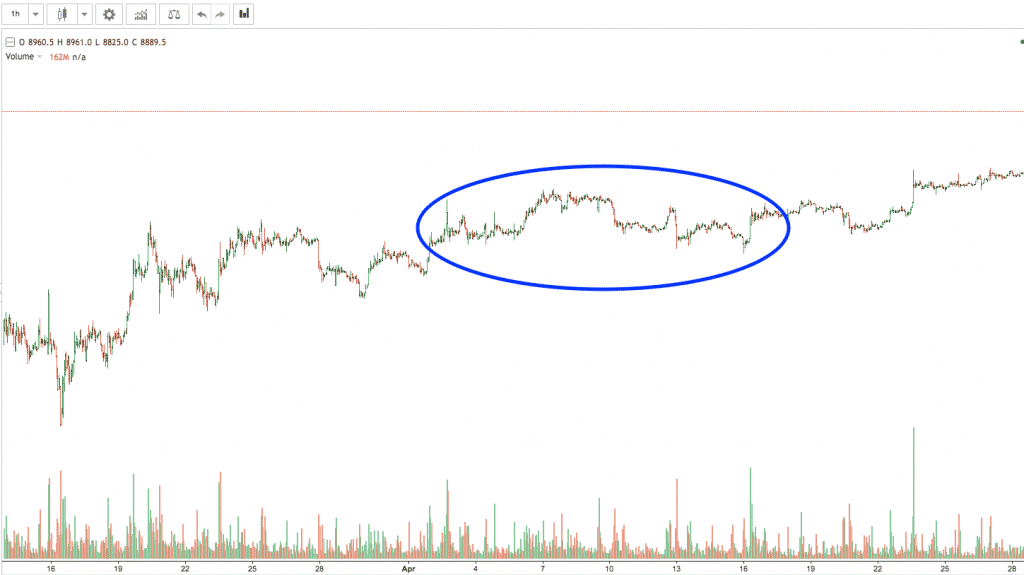

Here is a low-volatility example we are going to use:

This example is from the past few weeks of Bitcoin.

What we know is:

- Uptrend

- Low volatility

- Small

- Low volume

When this is the case, you need to trust that the market is not going to do anything crazy.

Without this trust, you will not have the conviction to enter, ever.

We know that in a low-volatility environment the price does not swing up and down very much.

It doesn’t move away very from trading ranges very much.

If you see this and you decide to trade it, you know you can wait for the coin to drop down a little before you enter.

Now, we know it’s an uptrend and it is showing low volatility.

You know the market will not continue down for very long until it turns back up again when it drops.

This is your setup (blue arrow) and here you can use an even smaller stop loss and a bigger position to maximize your profit potential and minimize your risk.

Did you see what just happened?

We used a low-volatility crypto trading strategy and made it a little more specific about where we enter.

You can trade all your ideas this way.

When you learn the behavior of your cryptocurrencies you will know when it’s the right time to change the strategy a little.

This is a strategy you can use in any low-volatility environment.

Crypto trading strategies for high volatility

We just saw how to upgrade a low-volatility strategy and make it better.

But how can we trade a cryptocurrency with higher volatility that is riskier?

What you can do is use the same strategy that you use for any high-volatility environment and upgrade it a little.

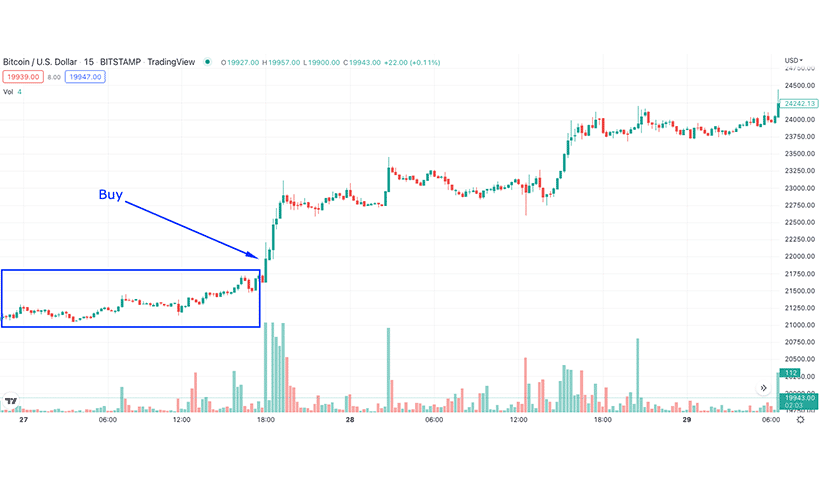

In this example, we are going to look at the same crash from before but this time on a lower time frame:

We are looking at the same crash but this time in a 15 min time frame.

What we are going to do with the crypto trading strategy we learned earlier is very interesting.

What we know is:

- Negative

- High volatility

- High volume

- Bigger

When this is the case we usually widen our stop losses and reduce the position size.

But inside this chaos, there will be periods of lower volatility.

The market is not going to swing up and down like crazy for 3 weeks straight.

The volatility ebbs and flows, in and out.

So the strategy we are going to use here is a little different.

We know the coin is collapsing and we know it is showing high volatility.

We are going to react to this behavior but we are going to enter during a low volatility period.

Where I’ve put the arrow is a perfect example of a low volatility area in this high volatility segment.

When this happens you have your chance to enter with a tighter stop loss and a bigger position.

This is because we know that the cryptocurrency is on its way down and it’s just a matter of time before it resumes the downtrend.

Don’t get this wrong and think it’s super easy to enter and that every scenario will look like this every time.

It’s not.

But with practice, it becomes a lot easier.

Remember that this is a trading strategy and it’s a way for us traders to approach the current environment.

All we did was analyze the coin to realize that it was acting with high volatility.

Then we took this information and created a trading strategy around that.

The principles are simple and you should keep them like that.

First, you need to learn the basics of creating crypto trading strategies.

Then you can start bending these strategies to make them fit the current conditions.

The more you practice, the more strategies you will find to use.

Crypto trading strategies for beginners

If you are just starting and you are looking for easy ways to make money in the markets I would recommend you to first follow the basics.

Learn how your chart is behaving and then apply the basic trading strategy.

One great way to learn quickly is to try your ideas in smaller time frames.

This way you will have more shots to fire and more time to practice.

I’m now going to give you a crypto trading strategy that any beginner trader can use.

This is a screenshot from the 5 min chart of bitcoin:

This is a positive trend and we have relatively low volatility and low volume in general.

The cryptocurrencies often make tests on the downside to shake off weak bulls.

When this happens you need to react to this behavior.

This is where a basic crypto trading strategy comes into good use.

When you have analyzed the behavior you can get ready to enter the market.

We know the coin is in an uptrend with low volatility.

This is perfect for a low-volatility trading strategy.

Before the chart resumes the positive trend it generally likes to dry out the volume on the downside test.

What you need to do is to find the area in the test where the market hits the lowest volume.

This is often a good time to enter.

If you hit this entry correctly, you will enter when it’s time to move on.

And the coin is also very small.

You can tighten your stop loss and increase the position size slightly.

This also takes practice but it’s one of many crypto trading strategies for beginners.

It’s easy to spot in the market and it’s easy to execute.

Try this in your own cryptocurrencies and be patient.

You may not execute the strategy perfectly in the beginning.

As long as you understand how a strategy works you are already ahead of many traders.

12 Crypto Day Trading Strategies to Boost Profits and Reduce Risks

Crypto day trading is a performance activity where traders get rewarded based on how good their strategy is and how well they use risk management. The best crypto day trading strategies come in many different forms and the truth is that not all strategies are a good fit for every trader.

Your strategy should be customized to your style of trading and the way you like to approach the market and the fact that each strategy can be used in different market environments makes them even more profitable.

It all boils down to who you are as a trader.

- Are you an aggressive trader?

- Are you a risk-averse trader?

- Are a beginner trying to find everything out?

Whatever your reason is for landing on this page I am sure that you will learn something new and fresh that you haven’t thought about before. I guarantee that you will exit this page with more knowledge and a better edge than you had before.

If you are trading cryptocurrencies on margin, check our guide on crypto margin trading strategies to learn how to make money with leverage.

Strategies you will learn

1. Focus on strong breakouts

Most new traders ask themselves “How I am going to make it as a trader and how do I make real money?”.

I totally understand your frustration.

You have probably traded for a while and you have come to the realization that you don’t know how successful traders actually make a living.

The answer to this question is that you need to focus your efforts on finding the best possible setups and allocate the most amount of money to these setups.

Crypto day trading does not provide a consistent stream of income where you make more or less the same amount of cash each month or every trade.

The way crypto traders make a living is by hitting it big a couple of times per month. This means that most of the trades they take are not providing enough money to support their commissions even.

The money comes from 2% of their trades which are traded in large breakouts and the reason breakouts are so powerful is because of the nature of how probability and momentum work.

In a true breakout, the market runs either up or down on extremely high volume, and it does so without looking back.

Strong breakouts don’t turn back to the range it was trading in before, instead, real breakouts carry on much higher, or lower for an extended period of time.

It is your job as a trader to identify when you see a possible breakout build-up and get ready to increase the position size and pull the trigger when it’s needed.

You will fail at first but after a while, you will start to learn how breakouts work and when to enter.

Once you enter a strong breakout setup with a large position you will make more money than you have made your whole career as a trader.

After a successful trade, you need to withdraw some of that cash and keep searching for the next strong setup.

Are you looking to become a skilled crypto trader?

Check out our detailed crypto trading guides in our educational center.

You will learn new strategies and how to read charts in real-time.

2. Bot trading

Nowadays you don’t need to have a degree in coding to run a crypto trading bot and make good money.

AI crypto trading platforms have made it extremely easy for beginners to automate their strategies and create powerful bots that can pretty much replace you as a trader.

Now, it may sound easy in theory, but it is a little bit more complicated than just pushing play and letting the algorithm do all work.

You first need to know basic trading theory and have some experience in trading the markets with a short-term strategy.

The best bot traders tend to be the kind of traders that come from a background of scalping and pure day trading.

You need to spend some time learning how the bot works and you need to be able to translate your strategy from thoughts into real rules or commands that the bot can adhere to.

Bot trading can be very effective once you learn how to use it and also which type of bot you should use for a different market environment.

You are not going to be successful by running the same bot without taking into consideration how the market is behaving.

Some bots do better in a choppy environment such as a trading range while others do much better in a trending environment.

The best way to get started is to learn the bot you are going to use and create at least three different types of bots so that you can change between them as the behavior of the market changes.

You will notice when your bot starts to function effectively as the profitability will go down which tells you that the market has changed and you need to swap between bots.

While your bot is trading the market you can spend some time working on other types of bots that can handle other types of market environments.

3. Use a smart stop loss

The best way to use a stop loss is to understand the level of volatility that is currently active in your marketplace.

Most traders get it wrong by using the same distance to their stop loss order which in turn will get them stopped out prematurely in 75% of the cases.

This is a big problem that can easily be solved with a couple of simple tools.

First, you need to know how much volatility there is in your traded coin.

The best way to find out the level of volatility is with the Average True Range (ATR) indicator.

This indicator will measure the magnitude of the price swings and it will give you a numeric translation that can be understood.

Once you have figured out how volatile your crypto asset is it is time to measure your distance and add your stop loss accordingly.

You need to play around with the ATR indicator to find out what level is considered as high, medium, and what is considered as low volatility.

Spend some time comparing the chart of your cryptocurrency and measure how much distance would have been required to stay away from the noise of the market without getting stopped out.

After a while, you will find out a smart distance to add your stop loss that will result in a higher win rate.

This doesn’t necessarily mean that you are going to make more money but it will keep you from losing less frequently, something that could be used to make more money.

When you have figured out the distance to your stop loss you only have to calculate your maximum risk per trade and size your position accordingly.

The smart stop loss system will force you to change your position size all the time as the market is changing, but remember, this is for the better.

Stop loss crypto exchanges with a trailing stop loss will give you a slight advantage if you don’t have much time to track your positions.

4. Focus on 5 coins or less

If you don’t know the behavior or the standard price action of the coin you are trading, then you are trading too many cryptocurrencies at the same time.

Proper day trading is based on pattern recognition which can only be obtained when studying a small number of charts every day.

It is literally impossible to trade 20 coins per day unless you are using an algorithm or bot that you have prepared with criteria beforehand.

Other than that, you can’t do it.

Well, you can do it, but you can’t do it well.

To increase your probability of success in cryptocurrency day trading you need to narrow down your targets to a few selected coins.

How do you choose which coins to trade and how do you find new crypto coins?

For starters, select some of the top 20 coins to be sure that they are going to be around for the years to come as many of the cheaper coins with a low market cap usually tend to get wiped out after a while.

Once you have found the coins you are comfortable with you need to start analyzing the charts religiously.

You need to spend enough time watching the price movement so that you can sense when there is a big breakout building up.

When you reach this level of awareness you will start to trade better because you will learn what is a good setup and what is a bad setup.

Professional traders are experts at recognizing good setups because they have to spend 10 years+ watching the charts of their favorite assets.

This is how you take your crypto day trading efforts to the next level.

5. Use leverage on the best opportunities

This is an advanced strategy for crypto day trading that should only be attempted when you have sufficient experience in how margin traded contracts work.

Leverage carries a significant risk of loss, however, if you know what you are doing you can make small fortunes by using leverage on your top setups.

Only by using a leverage ratio of 1:3 or 1:5 will increase your output immensely.

Think about your best setups and roughly how much money you make on those trades, now triple that or make it five times bigger.

It’s pretty crazy but it works well on those setups that you truly trust and believe are going to be big winners.

Leverage should not be used on every trade and especially if you don’t have a perfect setup yet.

If you are a complete beginner, stay away from leverage until you have learned how to use indicators and how price actions work.

If you scroll up in the article to the breakout strategy, this strategy goes hand-in-hand with that one.

Once you spot a big breakout building up and you are using a crypto exchange that offers margin you can take advantage of the setup and load up big.

As you know, it’s not going to work out in your favor every time, but when it does, it will yield fantastic results.

This is a great strategy to use for those who are looking for a way to up their gains without changing how they trade the market.

It is true that it comes with added risks and you might have to change your stop loss a little bit but except for that it is a great tool.

6. The trend is your friend

Intra-day trends do exist and they should be on your radar at all times when you watch the cryptocurrency market.

Day trading trends usually start with some kind of breakout from a previous trading range where the market builds up over a couple of hours or even days.

After the breakout, the market shifts its sentiment to a more positive or negative attitude and will see how traders line up to follow the trend.

Following trends is one of the best day trading crypto strategies you can use because they have the potential of producing good returns.

The most difficult part is to stick to your idea and not sell your contracts.

The best way to get past this bad habit is to force yourself to not sell unless you get stopped out.

You will soon find out that many of the positions that you used to close out too early are actually some of the best positions to hold on to.

Daily trends can last up to several hours and well into the next trading day depending on the momentum.

The characteristics of a good intra-day trend are very few pullbacks and mostly positive volume confirmation.

This means that the market falls down very few times and most of the volume hits the market as it is rising.

Once you see these signals you should immediately start thinking about sticking to your position.

A good tool to use is a trailing stop loss that follows the market as it increases.

Typically, however, you don’t want your stop loss to trigger the sell order. You want to sell once you see the first signs of negativity.

When the volume starts to turn to support the sell side you know people are taking profits and it’s time to get out.

Related: How to analyze crypto before investing

7. Cut losers fast and let your winners run

If you have been in the day trading scene for a while you have probably heard this one before.

However, if you are reading this article, you have probably not learned why and how to do it.

The reason why you’ve heard this so many times before is that losing trades need to be controlled and closed out very fast.

You see, losing trades that go beyond your risk limit can easily destroy your trading account if you are not careful.

Winning trades, however, are free to get as uncontrolled as possible as long as you know how to take profits.

But it doesn’t matter how much money you make on a winning trade, the more the better.

It is also true that every time you close out a losing trade there is a new chance that the next trade will be a winner and this is what every trader is waiting for.

The old saying “If you hang around a barbershop long enough, sooner or later you are going to get your hair cut” is a good comparison of how day trading cryptocurrencies work.

As long as you have trust in your strategy, and close out your losers fast, you will sooner or later experience big winners and when that happens it is important to let them run until there is no more momentum left.

The best traders I have met have been able to tell almost immediately if they are in a bad or good trade just by following the first ticks of the price action.

This is because they have seen enough trades that they know what a good entry looks like and as soon as they see something that looks “weak” they close out the trade and wait for the next opportunity.

This is a strong crypto day trading strategy that you should try to learn as soon as possible.

Related: How to take profits in crypto trading

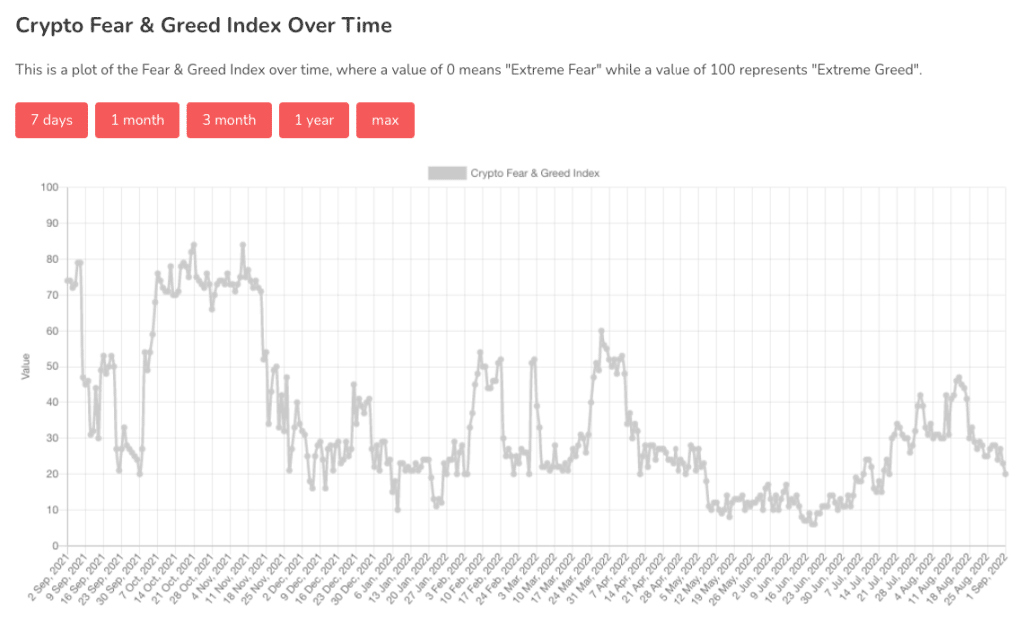

8. Measure the market sentiment

When I say to measure the market sentiment I am referring to the overall feeling of the crypto market.

It is important to know if the general sentiment is positive or negative before you start day trading your coins.

But how do you find out whether the market is positive, greedy, euphoric, negative, nervous, or hysteric?

First, start by looking at the overall trend. Check the daily chart to see if the market is currently in a downtrend or uptrend.

Now, zoom in to see the trend of the last couple of days to distinguish if the market is experiencing increasing or declining prices.

Depending on the current short-term trend you can gauge whether the market participants are positive or negative.

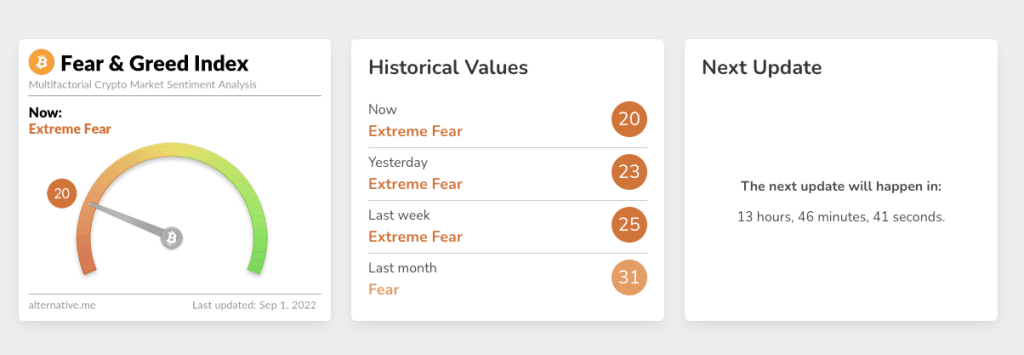

Another tool you can use is the fear and greed index which is a chart composed of different measures of the market participants.

The fear and greed index measures the market volatility, market momentum/volume, social media impressions, market cap dominance, Google trends, and some surveys.

All of these factors are plotted down on a chart that will tell you how fearful or greedy traders are at the moment.

You can take advantage of knowing how fearful or greedy traders are by piggybacking on their emotions and purchasing power.

If your technical analysis points to an increase in prices and the F&G index confirms this belief, then there is a good likelihood that you will succeed in going long.

Below is the reading for today, pretty negative I would say.

It should be mentioned that this index is not a tool that will solve everything by telling you which way the market is heading, it is a little bit more complicated than that.

However, it is a great crypto day trading strategy to have ready at hand.

9. Avoid overtrading

Why do traders overtrade and what is the real cure for this behavior?

Overtrading will affect every trader at some part in their early career and it really is a behavior that you can’t avoid if you don’t know the cause.

In my experience, I overtraded because I was so excited to trade. I want to get into the market and experience the rush of having a position in the market.

I overtraded, even more, when I increased my position size, and the bigger I traded the more excited I was about entering the market and seeing my results.

Do you see the problem here? What did I do wrong?

I let my emotions take over and control my trading, completely.

Trading is a strategic performance activity that requires clear planning and perfect execution without the interference of emotions such as fear or greed.

If you are excited, nervous, anxious, thrilled, or feel any other emotion about getting involved with the market you are in trouble.

In fact, you should not feel anything about your trading. It should be as systematic as possible and your only job is to create a strategy and follow it, religiously.

Now, the difficult part is to realize that you are overtrading. However, there are some clear symptoms that you can watch out for:

- You lose 80% of the time

- You pay a lot of commissions

- You feel like you are not in control

- You ask yourself many times “why did I enter that trade?” after you exit

- You are more focused on trading than analyzing the price action

If any, or perhaps all, of these symptoms sounds familiar you are probably overtrading.

The best way to fix the problem is to first realize what you are doing and then work on trying to make trading as “unsexy” as possible.

Good trading is boring and if you are enjoying yourself too much you need to change your strategies, mentality, and approach.

Overtraders need to step away from the market and find a strategy that suits their personality and that takes the focus away from clicking Buy or Sell.

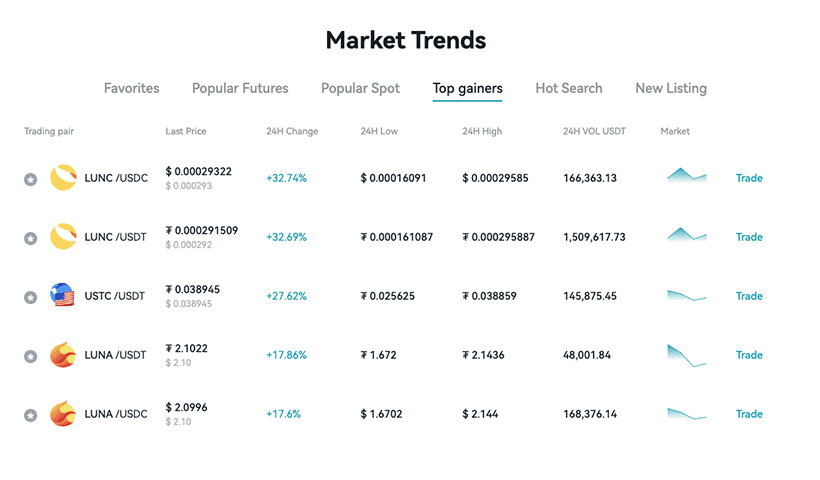

10. Find the daily volatility

As a crypto day trader, you need to follow the daily volatility and you need to have a system that can find the volatility for you.

But why is volatility so important?

It’s very simple, volatility equals movement, and movement equals potential profits.

Without a moving market, you cannot earn money because your positions will be chopping around in a small range.

Good day traders know that volatility is like energy for their trades that fuel their setups so that they can move in their favor.

However, volatility on its own doesn’t mean instant profits. Quite the opposite.

Traders that think volatility will solve all their problems are going to lose a lot of money.

Your strategy should always be built on top of volatile market situations but it should also be built on top of great risk management.

Volatility is just a force that will carry your position up or down depending on how you are positioned.

It is your job to read the market and trade accordingly with a fantastic risk management strategy in place for those times when the market goes against you.

After that, trading becomes a probabilities game, and the only thing you need to do is to repeat our setups over and over again.

The better your strategy and setup are the more often you will win.

After that, it’s up to the volatility to deliver on its promise.

The best way to find volatility while day trading cryptocurrencies is to use an exchange that lists the top daily gainers and losers.

Some exchanges I can recommend are Bitget and Prime XBT.

11. Use volume as confirmation

Volume is the number one predictor of continued market moves and the sooner you learn how to use it the better your results will be.

Think about it, what is volume? What does volume mean in any market?

I see volume as votes.

Every trader votes either bull or bear and all the votes are visible in the chart.

It’s almost as if we could see all the votes coming in during a presidential election, in real-time.

If that was the case we could easily see how in charge of the election and who is most likely to win.

It works the same in trading, both in the long term and in the short term.

If you see a setup that you think has a good potential for continuing higher, confirm the breakout with volume to see how many votes your setup gets.

If the number of votes increases as the market move in your direction then you know that you have some backup.

In that case, you should probably jump into the market and tag along with the majority of traders.

This is an extremely powerful technique that many professional traders use to gauge whether their position is worth holding on to.

The same thing is possible for the trades that you might want to close.

If you have shorted the market and you are not convinced about the setup and the volume seems to fade, then it’s probably a good idea to exit.

Most of the best altcoin trading platforms have volume indicators built into their charting interface.

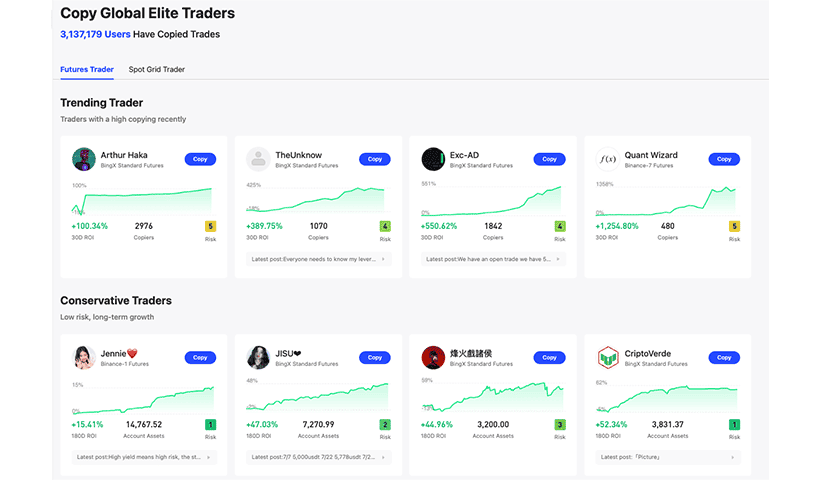

12. Copy trading

Copy trading is our last crypto day trading strategy and it’s a very new approach to how traders make money today.

I would say that if you are a beginner who is experimenting with trading and you don’t know much about how to get started it could be a good idea to let other traders trade parts of your portfolio.

The reason for this is that you can learn what kind of setups they use and especially with crypto copy trading platforms like Decoin, where you can see live when traders are executing trades in real-time.

Another great reason for choosing crypto copy trading is if you are a passive investor with little time on your hands and you want to put your money to work.

Your options are pretty much unlimited when it comes to the number of traders available to copy.

And they offer several different trading styles as well.

Most of the top crypto copy trading platforms like Bityard, Bitget, and BingX let you filter by trader’s profitability and their style of trading.

Some traders are more aggressive and will have larger drawdowns and some traders have a more conservative approach and take fewer risks.

This all depends on how you would like to invest your money and how much risk appetite you have.

If you are interested I would recommend that you start with a smaller investment.

Look for traders that have a consistent track record and have not just been lucky in the last couple of months by holding the most popular coins.

Copy investors can make a good passive income by selecting top traders and the key to this is diversity.

Don’t put all your money in one trader, spread out your risk.

It’s the same idea as when you invest in funds.

You want a little bit in commodity, a little bit in real estate, and some money in index funds, emerging markets, and blue-chip stocks.

Crypto trading tips that actually work are really hard to find today. Most of what’s out on the internet are just a bunch of click baits to lure in readers.

Today I’m going to share with you what I’ve learned so far over my years of investing in the markets. I’ve written down 15 crypto tips for traders that are easy to follow and that will work if you stick to them.

The trick is to learn only one at the same time. If you try to implement them all in one go, you will most likely explode with frustration because it takes time.

It takes time to build a solid mental framework for crypto. You should not expect yourself to learn these tips in an instant. But if you are committed to learning them, it will make all the difference for you.

The trick to trading cryptocurrencies profitably is to use your strengths as a trader and try to avoid your weak sides.

This is where we put rules into practice.

Rules come from tips that you hear from a friend or read online.

When you create a rule, it’s for two reasons:

Maximize your potential

Minimize the damage

When you start your journey you are bound to make a lot of mistakes that will make you lose money. The trick is to realize what you are doing wrong and stop yourself from doing that again.

It takes time and it’s very difficult, to be honest with yourself about any mistakes you might be making.

This is one of the reasons it’s so hard to become a good trader. Most people are not comfortable with criticizing themselves.

This is where you need to be different.

You need to be able to objectively look at the day or the week and see what went wrong.

Sometimes we make the most ridiculous mistakes, but that’s ok.

The trick is to realize we made a mistake, write down what happened, and also why it happened.

This will become the start of your new development as a trade.

Once you get used to looking at your own mistakes and taking responsibility for your actions, the rest gets a lot easier.

Let’s take a look at my top 15 crypto trading tips to help you become a more profitable crypto trader.

Top 15 Crypto trading tips that work

1. Only trade your own setups

You have probably heard this one before, but what does it mean? For a beginner trader, this doesn’t make much sense.

“I am trading my own setups if I’m sitting in front of the charts.”

When you have been trading your cryptocurrency for a while, you start to learn the behavior of the coin. This behavior will create a pattern every day and every week.

The more you study your coin, the more patterns you will find that repeat over and over again.

With good practice, you will learn what behavior and what setups are your favorite setups. These are the setups that will be profitable most of the time or at least make you money.

This will take some time to develop for every trader, so be patient.

When you study your cryptocurrencies and there are no patterns to trade, it will get boring.

Days will pass without any good setups lining up and you start to get frustrated because you want to make money.

While doing nothing feels like you are not trying to make money.

This will make you even more frustrated and you might end up entering the market without the signal of your own setups.

When this happens, you will most likely end up in a bitter stop loss while throwing your capital in the arms of the broker.

So, when you are scouting for the next good trade. Give the market time, good trades always come around.

Only trade your own setups.

When they come it’s obvious.

Great traders never have to look for good trades, if you have to look for a trade, there probably is no trade.

2. Use the correct stop loss

This crypto tip is also a common one but many traders struggle to use the correct stop loss.

If you don’t use a platform with a stop-loss order, read our guide on crypto exchanges with stop loss first.

“What is the correct stop loss for crypto trading?”

The answer is much easier than you might think.

Before entering your stop loss you need to know two things:

- How much money can I risk on any one trade?

- What is the average range/volatility of the current coin?

To find out how much you are willing to risk per trade, simply take 1% or 2% of your total capital. This is how much you should risk per trade to stay safe.

You can also divide your current capital by 10 and then divide this result vid 10 again. This will give you your 1% risk.

The second thing you need to know is the average movement, range, or volatility of the cryptocurrency you are currently trading. But why is this so important?

Most traders, around 70% – 90% get stopped out by normal rotations of the market. Regular up and down movements occur every day.

In general, crypto traders use a stop loss that doesn’t allow the market to freely move in the direction it’s heading.

Instead, most traders use a stop loss that’s too tight and they get stopped out minutes after putting on the trade, sometimes seconds after.

To avoid this you need to zoom out a little bit and take a look at the average movement of the market.

You can also use an indicator called Average True Range, or ATR for short. This tool will help you analyze the average range of the market.

What you do next is to put your stop loss at a safe distance outside of the standard rotations.

Don’t put it too far out because your stop loss will be too wide and you will lose size. Just enough to not get caught by the market.

The more you practice the better your stop losses will be.

Also, many traders are saying that if they put the stop loss at this distance, their position size will be very small.

That’s ok.

In the beginning, as a trader, your capital and position sizes will be small. That’s normal and you have to work your way up slowly.

So, use this tip every time before you enter the market. It will save you money and frustration.

3. Trade what you see

This tip goes hand in hand with how to read crypto charts.

Before you can start making money with cryptocurrency, you need to be able to read crypto charts very well. The trick to “trade what you see” is very simple and you can learn this today.

The difference between trading what you see and what you believe or what you heard from a friend is very small.

When you are looking at the cryptocurrency you are trading, you will start to learn how it trades. With time you will start to learn the story behind the price patterns, but this is more advanced.

Many traders do not listen to the price charts very well. If they did, they would do much better.

What I mean when I say listen to the charts I refer to this.

The charts will tell you a story about what’s going on. If there is negativity or positivity in the market. And also how positive or how negative the market is.

For many traders, it’s very difficult to get to the point where they can listen to the market and trade with the market. It takes many years to get to this level, but if you practice a lot, you will get there

Sometimes when there are very few opportunities in the crypto market, traders get frustrated and sometimes very sloppy with their decisions. This is when traders start to look for other signs of entry into the market.

It’s very dangerous because now the trader starts to listen to his friends, the news, or Twitter.

Even if the market is telling the trader that there is no trade today, or this week, the trader has the urge to enter the market.

This is human nature telling the trader to “DO SOMETHING”.

It’s not normal for a person to do nothing while at work, even though this is the case most of the time for traders.

So, when you are analyzing your charts and your cryptocurrencies, you need to trade what you see, not what you want to see.

If you can’t see the trade, there is no need to ask a friend or look for good trades on Twitter, because they are not yours.

If there is no trade today, wait a little.

Be patient and trade only what you see.

4. Don’t read the news

This crypto trading tip is something I learned the hard way.

I was reading a news source online about how the crypto market was about to explode. This was of course signed by some analyst.

This was so interesting to read and it really felt like the argument for the market to explode was spot on. I could not believe for a second that the market would do anything else than explode.

What ended up happening was the market tanked over 40% and I lost a chunk of my capital to the market makers on Bitmex.

Now I’m going to tell you why it’s so dangerous to read the news.

First I want to tell you how hard it is to predict the market correctly.

Out of all the professional traders on Wall Street, big institutions, and money-managing firms, the win ratio of the best traders is around 50%.

This means that for every second trade they expect to lose.

So, by listening to the best traders in the world you should only expect to earn money 50% of the time. I didn’t know this was true until I did some research. In fact, the number is even lower for most traders, this 50% statistic only applies to the best traders.

Back to the news story.

The people working for newspapers or online news sources have one job and one job only.

To create very readable content.

Absolutely no one on a news magazine has enough of a trading background to accurately predict any market. No less the cryptocurrency market.

So the next time you see a news article about the market, bitcoin, or any cryptocurrency, don’t read it.

It will give you no value at all. The only thing it will do is create an illusion that there is knowledge behind the writing.

So, if you want to make money trading cryptocurrencies, never read the news.

5. Don’t follow other traders’ ideas

If some random guy stepped up to you on the street and said “give me 100$ now and I will return 150$ tomorrow”, would you trust him?

Probably not, but why is it so easy for traders to take other traders’ advice with their own hard-earned money?

If you are serious about becoming a crypto day trader or swing trader you need to be able to listen to your own judgment and follow your own guts.

The best decisions are only made by yourself because you know why it’s a good decision.

When you listen to other traders online they know why this trade might work out or why it won’t. But you have no idea how to use this information.

They leave you with the final result of their own analysis and it’s up to you to handle it from there.

It’s almost like someone creating a machine with a lot of different parts that run the machine and you are asked to maneuver it.

It would be pretty hard to even understand why the machine runs as it does and what to do when things don’t work out.

The same goes for ideas that come from other traders.

I must say though, it took me years to realize this so I don’t assume you will learn this overnight. As you progress in your trading development you will start to open your eyes and understand why only your own ideas will work for you.

So, the next time you hear some advice from another trader, realize how many years it took him to learn the skills to come up with that idea. Then see how impossible it would be for you to adopt the idea and make every right move in the market.

Only follow your own ideas.

Are you looking to become a skilled crypto trader?

Check out our detailed crypto trading guides in our educational center.

You will learn new strategies and how to read charts in real-time.

6. Don’t trade just to trade

What is the biggest hurdle to becoming a successful crypto trader?

It’s the same hurdle every trader is fighting within any market. The hurdle of human emotions.

When you start your trading journey you have no idea what to expect, and most new traders do not know why it is so difficult.

The biggest obstacle to pass before you can become a profitable crypto trader is to understand and control your human impulses.

Nothing about trading is normal, think about this.

You work for 5 to 10 hours per day and you might end up losing 500$ or even more.

This risk combined with the uncertainty of the market makes it a very unsafe professional practice.

What makes it even more “dangerous” for most people is that the market doesn’t allow you to trade every day. Sometimes not even every week.

The market might be in a very low volatile period and there is nothing to trade, at all.

This is when most traders feel like they are making something wrong by only sitting on their hands for 5 days.

In fact, traders will get very frustrated and trade based on these emotions. They simply have to trade to tell themselves that they are doing something.

This is when it becomes very risky when you start trading only to silence the impulses that arise from doing nothing.

There is no analysis of these trades and they are forced onto the market with imaginary setups based on subjective thoughts about the market.

“The market has to turn, it has to start moving now”

“It’s been dead for one week, it’s ready to move”

“This is too cheap, I can’t let this pass”

These are some very normal thoughts you might think while doing nothing for a week, or two. The trick is to not listen to anything else than the market. If there is nothing to trade, there is nothing to trade.

You are better off reading a book about cryptocurrencies.

Learn to control your human emotions and impulses. That’s what trading is about.

Don’t trade just to trade.

7. Write down your trading setups

You will not understand why this is one of the best crypto trading tips until you try it. If you don’t try to write down your best setups you will not understand why it’s so powerful.

The only way to understand is to do it.

If you write down your top 5 setups or if you only have 1, that’s okay, you will start to see them much clearer.

Write down what has to happen in the market, what kind of behavior you need to see and which price patterns need to occur for your setups.

When you write it down in a document you cement the idea behind the setup. You will start to see the setup much more clearly in the market and you will also start to see when there are no setups as well.

Your setups will become second nature to you and you will recognize the setups much faster and earlier.

Another thing that will happen is that you will start to form new setups because you become so good at describing your current setups.

But of course, you will not understand this until you start to actually write down your own setups in detail, as well as you can.

If you want to take one step closer to making money with cryptocurrency, start writing down your setups.

8. Analyze your trading mistakes

How many mistakes have you made this trading week?

If you don’t know you are falling behind. You need to be able to explain what kind of mistakes you’ve made and also describe why you made them.

Mistakes come in many different shapes.

- You can trade too big

- You can trade too often

- Not trade at all

- Listen to a friend’s advice

- Read the news

- Trade because you want to make money

- Trade then you are tired

- Take a wild chance in the market

- Trade with hope

The list goes on and on.

The trick is to recognize that you made a mistake and accept it. When you truly accept that YOU made a mistake, only then can the process begin to reverse the mistakes.

Mistakes are like levels.

When you reach a level your job is to understand it and go through it.

What most crypto traders struggle with is analyzing the mistakes and answering the most important question.

“Why did I make that mistake?”

When you figure out what mistake you made and why you made it, only then can you start reaching new levels.

There is always something inside you that causes a mistake. You need to figure out what triggered the mistake.

- Were you frustrated?

- Did you want to make money right now?

- Was it because everyone else is making money?

- Did you just have to be in the market?

- Did you feel like gambling?

- Were you tired?

- Do you think trading is easy?

- Are you not taking trading seriously?

This list goes on and on as well.

Whatever triggered you to click Buy or Sell is up to you to find out.

Dig within yourself and if you can be honest with yourself the reason will show.

If you find the answer you can start to fix the mistakes by recognizing you are about to make a mistake before you make it.

This is pretty amazing when you learn how to stop your own mistakes. It’s also very profitable.

So, if you want to learn how to make money consistently as a crypto trader, analyze your mistakes.

9. Don’t fight the market

How many times have you tried to short a top that wasn’t a top, and the market just kept on grinding up?

This happens to every trader.

It’s very frustrating and it feels like you are targeted by some evil crypto god whose only job is to punish you.

Don’t worry, I have the cure for this and it’s easier than you might think.

The reason why you can’t seem to get the short positions right or why you can’t ever buy a bottom in the market is that you are trading with a subjective idea.

For some reason, you just happen to think that the market is too expensive or too low and it has to turn. Literally, every trader has had these thoughts so you are not alone.

When I was learning how to trade I was so frustrated with this so I started to ask myself what was going on.

Why am I fighting the market over and over again when I can’t beat it?

The truth is that you are not fighting the market, you just don’t know what a positive or negative market is.

That’s it.

If you knew what positive market behavior looks like or what negative market behavior looks like you would not have this problem.

So, my first advice would be to practice extra hard to understand your own market first.

If you need to, take a few weeks off from trading and only focus on understanding your market. How is it behaving when it’s positive and when it’s negative?

When you learn this, you will stop shorting what you think is a top and instead buy the dip that will come in a few days.

You will also stop buying what seemed like a bottom before, you will wait until the market bounces so you can short sell it.

Don’t fight your market.

Learn how it behaves instead.

10. Learn to take profits

It sucks to give back money to the market, especially when you have made all the right decisions and you are in the money on the trade.

How many times have you seen your good 10% or 20% turn into a loss of -25%?

The reason you can’t seem to learn how to take profits in crypto is that you are greedy.

It’s that simple.

You also think that this is the last profitable trade you will ever be in so you have to squeeze the last penny out of the market because this will never happen again.

That is not true.

The market is literally full of opportunities.

To change this behavior of yours you need to change your mindset about your trades.

First, realize that there will be many profitable trades in the future. This should make you a little bit more relaxed.

Then, understand that you can’t hit mega-winners every time you put on a trade.

To really be a good trader you need to understand when to hold and when to fold a trade.

And this takes time.

Don’t be in a hurry to become a master at this because you need practice. So focus your attention on taking profits at a fixed % on the next trade.

Ask yourself before you enter the market.

“How much can I expect from this market?”

Is it 5%, 15%, or 25%?

When you have your estimated number, lock it in for the future and make a promise to yourself to profit when this target hits.

If you can do this you will take a huge step forward in your development.

More advanced versions of how to take profits will come with experience so keep practicing.

Remember to plan your trade and take profits off the table.

11. Leave your ego outside

Cryptocurrency trading is lonely, especially if you are serious and want to make real money.

Have you ever thought about how much money everyone else seems to make out of the market every year? And how many cool cars all the crypto traders on Twitter have?

Let me tell you one thing.

Most of it is fake and not true.

You need to understand that most traders on Twitter are not making the money they say they are making from trading. They probably have another side business that provides for them.

Trading is hard, it takes real effort to succeed.

If you want to make money trading cryptocurrencies you need to forget about everyone else and focus on yourself.

It’s all about you and what happens to everyone else doesn’t have anything to do with you. You should only look at your own path and your own progress.

That’s what matters.

You should focus on becoming a better trader every day. Take small steps towards your goals and grind.

It doesn’t matter how much money everyone else is making if you’re not serious enough about your progress.

What is more important to you?

That you compete with other traders or that you have steady growth every day and every week?

You pick what’s most important to you and if you leave your ego outside you will speed up the process.

12. Lose small

If there is one rule that stands out by professional traders it’s to not lose your money. I will tell you why this is so important.

If you lose big on your trades you can’t have a positive expectation of your trading results.

Big losses cut your business.

Think of it the other way. What would happen if you started to win big very often? What would happen to your account size?

It would grow, definitely.

Now reverse that idea and you have the reality of big losses. It’s kind of scary but when you think about it this way you can really see the damage it does.

Also, as you get more experience, your profitable trades will take care of themselves. The only thing you have to do is to avoid big losses.

Imagine for every trade you put on, you aim for a big win. You will not close the position until you have a big fat profit to take home.

Now, combine that with avoiding any big losses. What will that result in?

If you have this mentality when you trade you will certainly not take any big losses.

But you will of course not take big winners every time. But what will happen is that once in a while you will hit a really good trade and the profit from that one trade will be enough to support your trading for months.

Remember, lose small and aim big.

13. Learn when not to trade

This is a tip I want to highlight. You don’t need to trade every day or every week.

Why?

Because there are not that many great setups in the market and if you keep trying to find them you will throw away good money at bad setups.

I would say that there are approximately two good setups every month in the crypto market, on average. Sometimes there are four and sometimes only one.

What you need to do is to learn what a good setup is and then realize when there is no setup to trade.

If you can do this, it will become boring to trade but more profitable.

The market needs time to accumulate before a good move and it also needs some time to unload supply before it turns back down.

It takes time for the market to turn, both ways.

When you see this it will become clear to you that you can’t be in the market all the time.

Also, if you are trying to enter the market every day you are aiming for too small movements. Some people can scalp the market but it’s not for most people.

If you see that you lose money too often, that you have no quality in your setups, and that you have no confidence behind the strategies, step away from the market and wait.

While you are not in the market, analyze what’s going on. Read the story the market is telling you and wait for your setup to come around.

When you are waiting for the next good setup, other traders are trading in and out of the market every day laying the foundation for your next big move.

If you learn when not to trade, you will also learn when to trade.

14. Don’t trade too big

It will take you a few years to realize that trading big is not going to make you money.

What will happen is you will stop yourself out too soon and too often. Your trades will become very difficult to stand and you will not feel comfortable.

The solution to this is to understand that bigger trades will not make you more money. They can make you more money if you enter the market with laser precision.

Most traders can’t do that and it’s nothing to strive for.

Instead what you should do is to take the slow game. Take a few steps back and cut your position size to a level you feel comfortable with.

You should trade a size where you don’t need to watch the market while you are in the trade.

You should be able to put on a trade and leave the computer for a couple of hours and then come back to see the results.

You will make far less money on each profitable trade, but you will make far more profitable trades, that’s for sure.

This is something you will not learn until you either learn it the long and hard way or before you actually try to implement it yourself.

You might say that this will never make you any money and that’s not true.

It will not make you money today or next week. But if you stay consistent and increase your position size only after good trades you will start to trade bigger sizes with time.

So, if you are the kind of trader that is taking on too much size, take a step back and accept that it’s not the way to go.

You only trade too big because you want to make money quickly, but that’s not going to happen in this business.

If you don’t believe me, I dare you to try one month of trading with only 10% of your position size.

Then take a look at your results at the end of the month.

15. Have a curious approach to your positions

For most traders this tip is new but I will explain why it’s so important.

When you enter the market with any position you will naturally have expectations, either good or bad.

What happens when you see the result of your position is, you get excited and happy or mad and frustrated.

These emotions will control your trading in ways you can’t even imagine. If you have a string of winners you will be very excited for the next trade and you will get overconfident that you will win again.

If you have a series of losses you will get shy and the conviction of your positions will be very low.

Here is how to fix this and how to have the correct view of your positions.

Whenever you are about to enter the market, long or short. Think about your position as something that is not at all connected to you and the only thing you want to know is:

- What will happen to this position?

This should go through your head with a very neutral bias before you enter the market.

You should not care if it’s a winner or a loser, you should only have a very curious attitude toward the position.

Almost like you don’t even care about what’s going to happen.

If you can learn how to keep this distance between yourself and your position you will be one step closer to making money as a cryptocurrency trader.

Be curious.

Browse similar articles

FAQs

Depending on the behavior of the cryptocurrency you need to trade it differently.

Read through this article to find out more information.

The short answer is yes. As long as you control your risk and don’t let emotions get in the way of your decisions.

Cryptocurrencies might be the future of trading. But for now, they are hardly recognized as a mainstream asset class.